The Cautious Road Ahead: Analyzing the Current Landscape of India’s Two-Wheeler Market

Bajaj Auto, one of the leading players in the Indian motorcycle and three-wheeler industry, has recently adjusted its growth expectations for the two-wheeler segment to a modest 5% for the fiscal year 2025. This is notably lower than the previously anticipated growth range of 5-8%. The company’s projected performance paints a picture of cautious optimism amidst marketplace challenges, revealing critical insights into the evolving dynamics of consumer behavior and market demand.

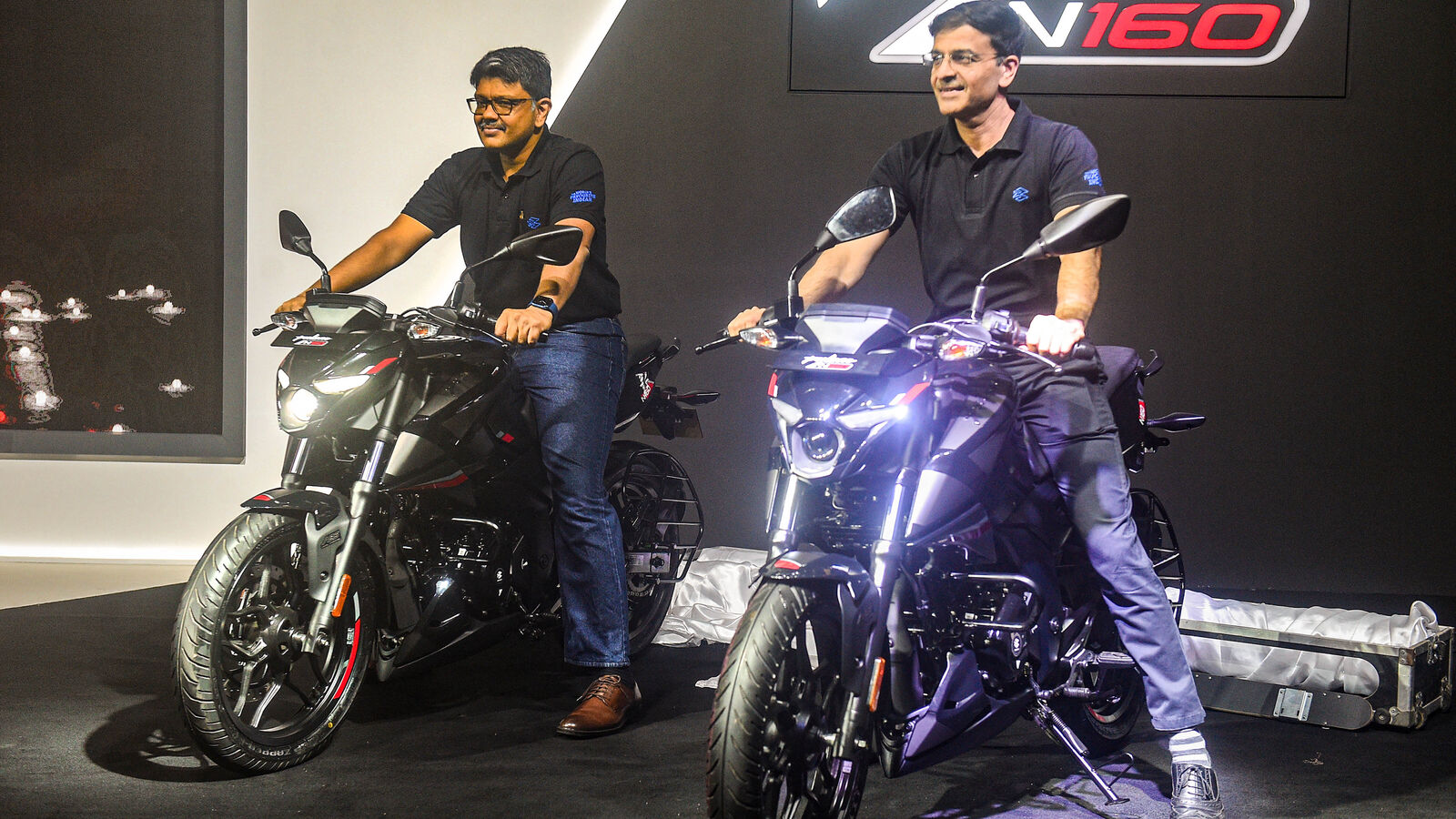

Bajaj Auto’s evolving product lineup

Bajaj Auto’s evolving product lineup

The Struggle for Entry-Level Vehicles

Despite aggressive marketing strategies, including price discounts ranging from ₹5,000 to ₹6,000 on entry-level motorcycles, this segment remains stagnant. Rakesh Sharma, Bajaj Auto’s Executive Director, highlighted the significant struggles faced by this market tier during a recent earnings call. He stated,> “We are seeing a very clear trend where the entry-level motorcycle market is in decline.”

This trend is particularly concerning, as the expectations for a rebound in the post-pandemic arena have not materialized. The last few weeks indicate a slight reversal in sales, which had initially looked promising after the COVID-19 crisis. The sluggish performance is underscored by a broader industry context where Bajaj now expects to see overall two-wheeler growth flat-lining at just 1-2%, indicating a crucial shift among consumer preferences, particularly towards the 125cc and above segments.

Premium Market Performance

Interestingly, while the entry-level segment continues to falter, the premium two-wheeler category is witnessing more favorable growth, estimated at about 5-6%. This shift in consumer demand, now accounting for approximately 55% of market sales, reflects a broader trend towards higher displacement motorcycles. Such a pivot assists Bajaj in navigating the impact of weak entry-level demand, although it does not fully compensate for the complete slow down observed in the industry’s performance.

In anticipation of this shift, Bajaj is betting on strengthening its presence in the premium segment. Their refreshed Pulsar portfolio and the newly launched Pulsar 125 are aimed at attracting younger riders, incorporating modern design and features that appeal to today’s tech-savvy youth. Additionally, the launch of the Freedom CNG motorcycle aims to solidify their market position across varying segments, regardless of trends.

The new Pulsar 125 designed for youth appeal

The new Pulsar 125 designed for youth appeal

Festive Season Anticipation

As the festive season approaches, expectations were initially set high, with anticipated growth in motorcycle sales of around 6-8%. However, Sharma commented on a disappointing outcome, recounting a muted sales performance during the recent festival period, which registered growth between just 1-2%, mirroring last year’s figures. Hindered by lackluster demand from key regions, such as the southern and eastern states, the festive season appears gloomy. Sharma noted,

“We will be lucky to see a 3-5% growth for the industry in the festive season.”

Industry data from the Society of Indian Automobile Manufacturers (SIAM) further corroborates this sentiment, indicating a 2% decline in two-wheeler volumes during the first half of the fiscal year. Factors contributing to this downturn include delayed rural incomes and election-related disruptions, presenting a multi-faceted challenge for manufacturers like Bajaj.

The Shift Towards Electric and CNG Innovations

In a bid to adapt to the changing landscape, Bajaj Auto is set to unveil an upgraded portfolio of their electric scooters under the Chetak brand this November. While Sharma maintains that the newer version won’t drastically differ from its predecessor, he assures enhanced performance and beneficial profit margins for the company. This evolution represents Bajaj’s efforts to maintain relevance in the rapidly growing electric vehicle market.

Another element of their strategy includes a focus on CNG-powered motorcycles, with the Freedom 125 CNG gathering positive attention and sales performance, exceeding 10,000 units in demand. To further capitalize on this interest, Bajaj plans to increase production to 30,000 units per month starting from November, signaling a strategic push into alternative fuel options as part of their growth plan.

Conclusion: Navigating the Future of Mobility

Bajaj Auto stands at a critical juncture as it tackles the challenge of evolving consumer expectations while striving to maintain competitive advantages in key segments. The company’s dual strategy of engaging more robustly with the premium two-wheeler market while simultaneously innovating in electric and CNG segments reflects a proactive approach to safeguarding its market share.

The continued fluctuations in demand within the lower-tier segments indicate a need for agility and adaptation from players in this space. As Bajaj Auto pushes forward, the overarching narrative underscores a crucial transition in India’s automotive landscape and hints at the necessity for manufacturers to pivot swiftly toward technologies and segments that align with changing consumer demands.

The future of two-wheelers: Electric mobility

The future of two-wheelers: Electric mobility

As Bajaj navigates these uncertain waters, it will undoubtedly be watched closely by competitors and consumers alike, all eager to see how this giant adapts to the new realities of the market.