Consumer Cyclicals: Riding the Highs as Discounts Persist

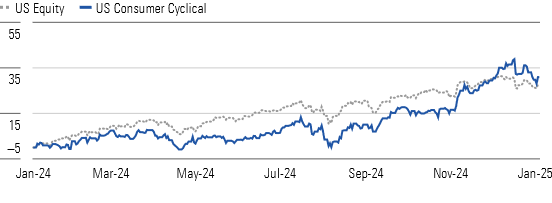

As we close out 2024, the consumer cyclicals sector is showing significant momentum, with many stocks—including my top picks, Under Armour and Polaris—leading the charge. The Morningstar US Consumer Cyclical Index has seen a remarkable uptick of over 10% in the fourth quarter, outpacing the broader market’s modest 3% rise. This performance shift has pushed many stocks closer to fair value, yet roughly one-third of these remain in the undervalued territory.

Performance snapshot of the consumer cyclicals index.

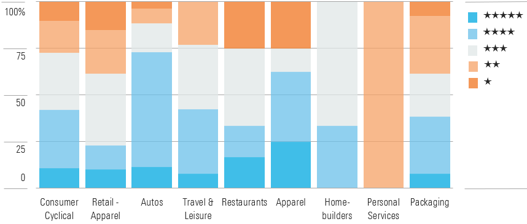

The median price of stocks in this sector now reflects just a 4% discount from fair value, a significant improvement from an 11% discount reported three months prior. Yet, amidst this positive movement, the apparel sector stands out as the most undervalued, with discounts nearing 30%. Around 60% of the stocks within this category are rated between 4- or 5-star.

The Apparel Advantage: Discounts Remain Attractive

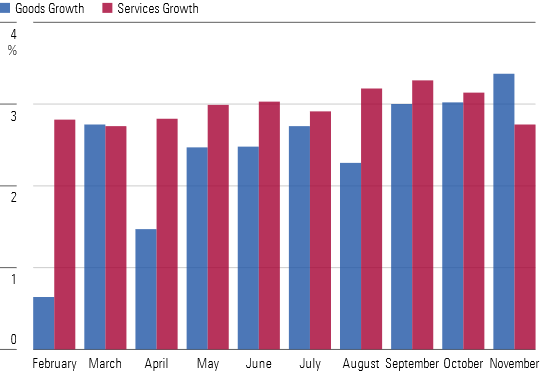

It’s intriguing to see how the economic climate is influencing consumer behavior. After a turbulent period marked by uneven growth and significant supply chain disruptions following the pandemic, consumer spending shows signs of normalization. In November, spending on goods surged by 3.4%, a stark contrast to the 2.8% growth observed in services. To put this in perspective, January’s numbers were disappointing for goods at just a 0.6% uptick compared to services that resonated at 2.5%.

Exploring the dynamics of consumer spending trends.

For brands in the apparel sector, this could translate into stronger revenues as they ramp up investments in product lines and marketing endeavors. It is worth nothing that while consumer spending on services is predicted to maintain a steady rhythm, demand in the travel segment should endure, albeit at a more subdued growth rate than in 2021.

Resilience in Services Amid Economic Fluctuations

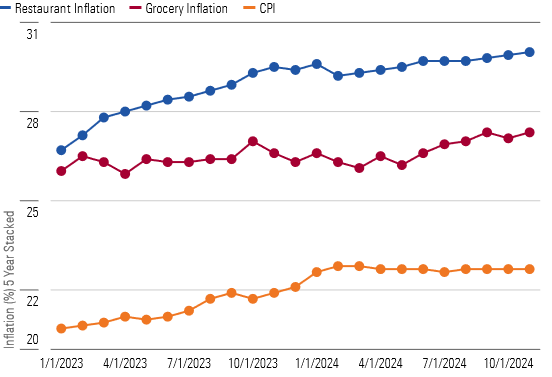

As inflationary pressures have begun to ease, the restaurant industry is still grappling with the ramifications of rising food and labor costs. The disparity in inflation rates has widened notably; restaurant prices have increased by 30% on average since 2019, leading to a concerning decline in customer traffic. Promotions aimed at boosting patronage have added strain, suggesting a critical need for operational efficiency in the year ahead.

Assessing the current economic landscape and its impact on spending.

Key Takeaways for Investors

While the discount phenomenon may be dwindling, the landscape is ripe with opportunities, particularly in the apparel segment. As we observe the shift in consumer habits and the adaptiveness of brands, some stocks may be underappreciated despite their growth potential. In an environment where consumer sentiment is resilient and spending stabilizes, identifying these undervalued assets should be a priority.

Furthermore, both Under Armour and Polaris represent compelling narratives within this evolving market. They are not only capitalizing on the uptick in demand but are also navigating the challenges with agility. As consumers lean toward goods over services, brands with strategic foresight will likely outshine their competitors in the months ahead.

By keeping a close eye on valuation metrics and market dynamics, savvy investors can seize the opportunities presented in the cyclical space, reinforcing the notion that careful analysis and timing are paramount for success.

Understanding the shifting tides in consumer preferences.

Overall, it’s clear that the consumer cyclicals sector is primed for a promising future. With a few strategic plays, not only can investors navigate the market effectively, but they might also enjoy substantial returns as these cycles unfold.