Indian Telcos Securing Massive Discounts on Network Gear

The Indian telecommunications sector is witnessing a significant shift as major players like Reliance Jio, Bharti Airtel, and Vodafone Idea have landed remarkable deals for network equipment at much lower prices. With vendors such as Nokia and Ericsson focusing on the vast Indian market, these deals highlight the country’s importance amidst a global decline in revenue for these companies.

The expansive landscape of Indian telecommunications.

The expansive landscape of Indian telecommunications.

The Bargain for Network Equipment

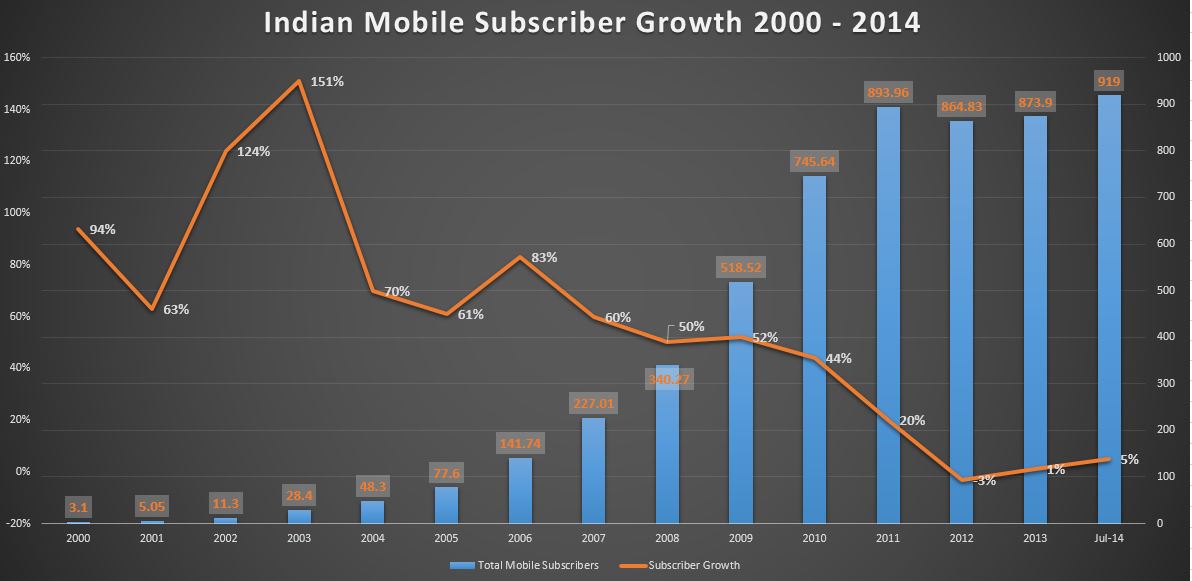

In a surprising turn of events, Indian telecom operators have been able to secure base transceiver stations (BTS)—key components for maintaining 5G networks—at a staggering 30-40% discount compared to global prices. A typical macro BTS, priced around $50,000, is now being sold to local telcos for a** 40% reduction in costs**. This strategic pricing is largely influenced by India’s vast scale in network deployment, as it currently boasts approximately 1.21 billion telecom subscribers.

Impact of Lower ARPU

Despite these discounts, India’s average revenue per user (ARPU) remains among the lowest globally. This presents a double-edged sword for service providers in the region. Vi’s Chief Technology Officer, Jagbir Singh, emphasizes the heavy capital expenditure required to maintain networks amid comparatively low revenue inflows. This paradox pushes operators to secure affordable equipment while striving to enhance service quality and network efficiency.

Vendor Strategy: India as a Growth Hub

The allure of the Indian market for global vendors cannot be understated. Even amidst a decline in revenue figures—with Ericsson’s revenue dropping 11% to $10.7 billion and Nokia experiencing a 21% decrease to $9.9 billion—India is still seen as a “bright spot” for growth. Recent contracts signed by Vodafone Idea, for instance, amount to approximately ₹30,000 crore, signaling the strategic importance of entering or expanding in this market.

“India offers much expansion opportunity with both 4G and 5G,” stated a Nokia representative.

Innovative technology driving the telecom sector forward.

Comparative Pricing in Global Context

When we delve into comparative pricing, it’s clear that India routinely enjoys significantly lower costs for modern technology. Equipment benchmarks demonstrate that pricing in India and China typically carries a 35-40% discount versus markets such as Europe, the Middle East, and North America. This dynamic effectively positions India as an attractive destination for vendors seeking to maximize market share, even if it means compromising on profit margins in the short term.

Future Prospects

Looking forward, the Indian telecommunications landscape is predicted to stabilize and diversify as both 4G and 5G networks continue to expand. Reports state that vendors are on the verge of securing a $1-2 billion deal with Bharti Airtel while previous financial forecasts highlight that India will significantly contribute to global revenue for years to come. This optimism comes on the back of substantial investments made by telecom giants like Reliance Jio and Airtel, particularly in 2023, which are set to change the operational efficiencies within the sector.

Conclusion

As the world grapples with the enormous shifts in technology and economic landscapes, India stands out as a realm of opportunity for telecom businesses. The interplay between sustainable pricing models and substantial user bases is set to fuel fierce competition and innovation in the coming years.

The future of telecommunications in India looks bright.

While navigating through these strong business dynamics, the Indian telecom industry is more than just about pricing—it’s about positioning and innovating for long-term success.

For more details on the ongoing evolution within this sector, follow the latest updates from Economic Times Telecom.